Little Known Questions About Home Appliances Insurance.

Home Appliances Insurance Things To Know Before You Get This

Table of ContentsThe smart Trick of Home Appliances Insurance That Nobody is Talking AboutThe Main Principles Of Home Appliances Insurance Home Appliances Insurance Things To Know Before You BuyThe 4-Minute Rule for Home Appliances InsuranceFacts About Home Appliances Insurance UncoveredLittle Known Questions About Home Appliances Insurance.

Certified service warranty business have a Building and construction Contractors Board (CCB) certificate number. We can confirm that number for you. Provide us with duplicates of communication or paperwork you get from the company so we can assist them abide by the regulation.Have you ever questioned what the difference was between a house service warranty as well as house insurance coverage? Both protect a house and a home owner's pocketbook from pricey repair work, but just what do they cover? Do you need both a house service warranty and house insurance coverage, or can you get simply one? All of these are outstanding questions that several house owners ask.

What is a home service warranty? A house service warranty protects a home's interior systems and also home appliances. While a house service warranty contract resembles house insurance policy, especially in exactly how a home owner uses it, they are not the same point. A house owner will certainly pay an annual costs to their residence warranty business, usually in between $300-$600.

The Best Strategy To Use For Home Appliances Insurance

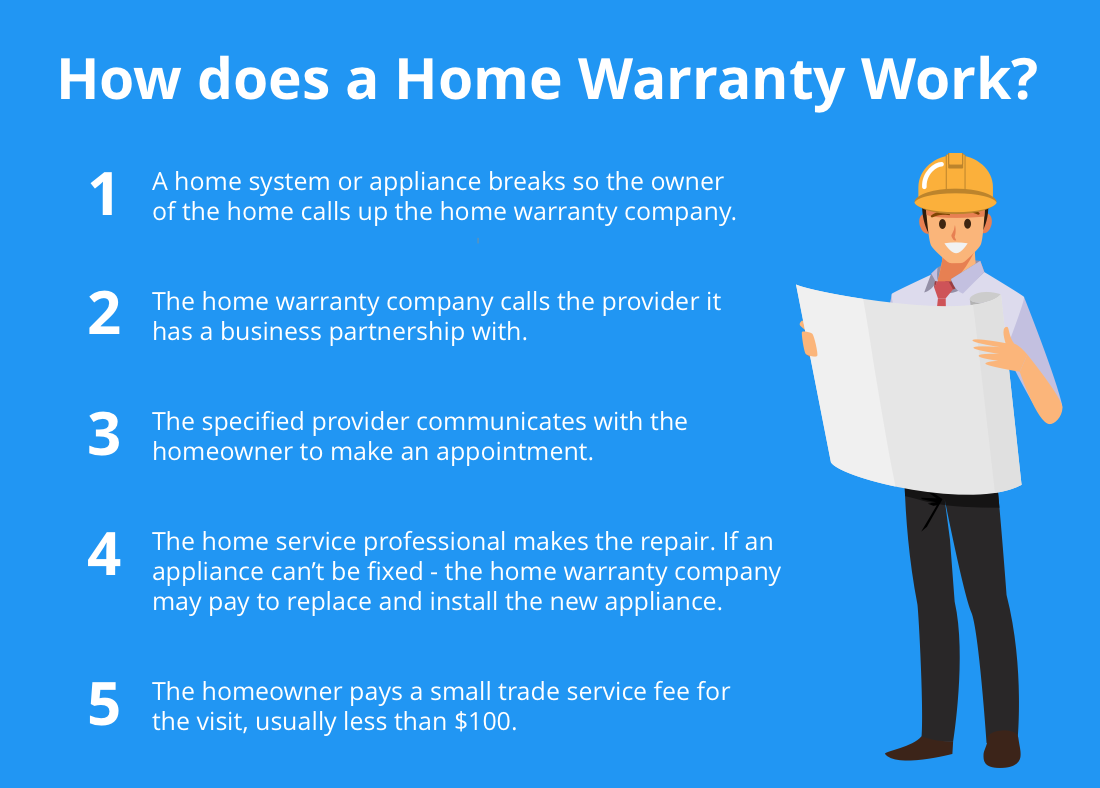

If the system or home appliance is covered under the house owner's house guarantee plan, the residence guarantee company will certainly send a specialist who concentrates on the repair service of that specific system or appliance. The property owner pays a flat price service call cost (normally in between $60-$100, depending upon the home service warranty business) to have the service provider come to their home as well as diagnose the trouble.

What does a house service warranty cover? A residence service warranty covers the major systems in a house, such as a residence's heating, air conditioning, pipes, and electric systems. A residence guarantee might likewise cover the larger appliances in a house like the dishwasher, stove, fridge, clothes washer, and also clothes dryer. Residence warranty firms typically have various strategies available that supply protection on all or a pick few of these items.

The Greatest Guide To Home Appliances Insurance

Home insurance policy may additionally cover clinical expenditures for injuries that individuals received by getting on your residential property. A home owner pays a yearly premium to their home owner's insurance policy company. Usually, this is somewhere between $300-$1,000 a year, depending on the plan. When something is harmed by a disaster that is covered under the house insurance coverage, a home owner will call their residence insurance policy company to submit a case.

Home owners will normally need to pay a deductible, a fixed quantity of cash that appears of try here the home owner's wallet before the residence insurance firm pays any type of cash towards the insurance claim. A house insurance policy deductible can be anywhere in between $100 to $2,000. Generally, the higher the insurance deductible, the reduced the annual costs cost.

What is the Distinction Between Home Guarantee and also Residence Insurance A residence warranty contract as well as a house insurance coverage run in comparable means. Both have an annual costs and a deductible, although a house insurance premium as well as deductible is commonly a lot greater than a house service warranty's. The major distinctions in between residence service warranties as well as residence insurance policy are what they cover (home appliances insurance).

All About Home Appliances Insurance

If there is damages done to the structure of your home, the proprietor won't need to pay the high prices to repair it if they have residence insurance (home appliances insurance). If the damage to the residence's framework or home owner's possessions was caused by a malfunctioning devices or systems, a home warranty can help to cover the costly fixings or substitute if the system or device has actually fallen short from normal damage.

They will certainly collaborate to give security on every part of your home. If you're interested in acquiring a home service warranty for your home, take an appearance at Spots's house warranty strategies and also prices below, or request a quote for your home here (home appliances insurance).

Indicators on Home Appliances Insurance You Should Know

"However, the extra systems you include, such as pool coverage or an added heating unit, the higher the cost," she says. Adds Meenan: "Rates are usually negotiable as well." Other than the yearly cost, homeowners can anticipate to pay usually $100 to $200 per solution call browse through, here relying on the kind of agreement you acquire, Zwicker notes.

"We paid $500 to sign up, and after that needed to pay another $300 to clean the main sewer line after a shower drain back-up," states the Sanchezes. With $800 out of pocket, they assumed: "We really did not gain from the residence warranty in all." As a young couple in one more home, the Sanchezes had a challenging experience with a home service warranty.

The 6-Minute Rule for Home Appliances Insurance

When the service technician had not been pleased with a reading he obtained while checking the heating system, they say, the business would not accept coverage unless they paid to change a $400 component, which they did. While this was the Sanchezes experience years ago, Brown verified that "evaluating every major appliance before supplying coverage is not an industry requirement."Constantly ask your service provider for quality.